For Employers

Increase employee engagement and help your employees save more. LINK’s modern platform helps you attract, reward and retain your industry’s top talent with group plans that encourage financial wellness, reduce turnover and create a culture of caring.

Be an employer of choice

Attract top talent by offering affordable employer-sponsored benefits including workplace savings plans that promote simple and disciplined wealth accumulation. LINK supports employers with retirement savings solutions that help companies gain a competitive edge in attracting leading talent.

Reward employees for their hard work by helping them reach their retirement goals. Improve employee appreciation, motivation and engagement with an affordable retirement plan designed to maximize their long-term savings goals.

Retain your best employees with an engaging plans. Employee turnover is costly and counterproductive but with LINK business can support employees. Reduce financial stress, increase loyalty and prevent employee churn with plans that helps you keep valuable employees by enabling them to achieve their financial goals. Most workplace savings plans are free to the employer other than matching contributions.

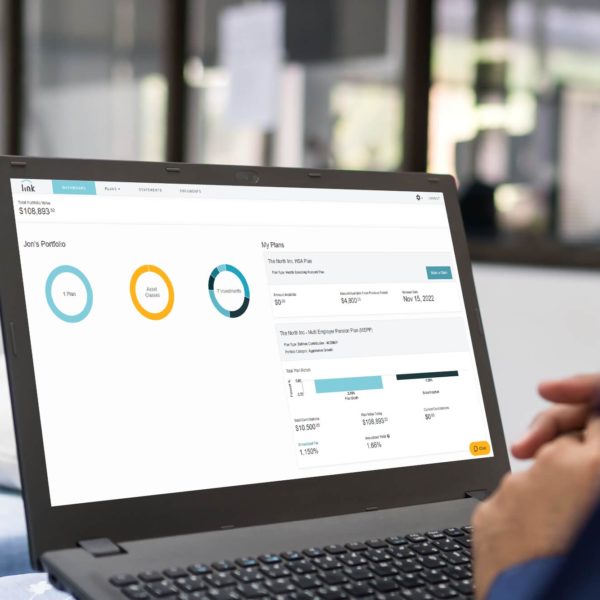

Easy to manage workplace savings plans

Simplify your plan management from one dashboard. Our convenient and secure cloud-based platform reduces the pain points associated with plan administration. LINK’s self-serve portal makes it easy for you and your plan members to onboard, view account details, submit claims and more.

Where LINK Helps

- Group RRSP

- Multi Employer Pension Plans

- Defined Contribution Pension Plans

- Group Tax Free Savings Accounts

Group Registered Retirement Saving Plan

Help your plan members save for retirement with a Group RRSP (Registered Retirement Savings Plan). Give your employees more incentive to participate with employer matching options. A Group RRSP provides plan members with the benefit of pre-tax payroll contributions and investment earnings are tax-sheltered until withdrawal.

Benefits of LINK’s GRRSP:

- Lower fees and suitable investments

- Contributions are eligible for Home Buyers’ Plan (HBP) and Lifelong Learning Plan (LLP)

- Build employees retirement savings by matching their contributions

Multi-Employer Pension Plan

Support your plan members retirement income with Link’s Defined Contribution Multi- Employer Pension Plan (DC MEPP). MEPPs help plan members save for retirement since most contributions are locked-in and cannot be withdrawn early.

Benefits of Link’s MEPP:

- Lower fees through pooling and Link acting as plan sponsor and administrator

- Tax-deductible contributions

- Locked-in contributions help employees save for retirement

Defined Contribution Pension Plans

Help support your plan members during retirement with a Defined Contribution Pension Plan (DCPP). Both employer and employee contribute a defined amount annually into the DCPP helping ensure employees have an income during retirement.

Benefits of Link’s DCPP:

- Lower fees

- Tax-deductible contributions

- Contributions locked-in for retirement

Group Tax Free Savings Accounts

Setting up a Group Tax Free Savings Account (GTFSA) offers your plan members a flexible tax-free investment option to help them save for their short and long-term financial goals. Plan members can use it towards vacations, education, home renovations or other life events. GTFSAs are a great addition to any retirement savings plan.

Benefit of Link’s GTFSA:

- Lower fees

- No tax on their investment earnings or withdrawals

- Contributions can be made through regular payroll deductions

Group RRSP

Help your plan members save for retirement with a Group RRSP (Registered Retirement Savings Plan). Give your employees more incentive to participate with employer matching options. A Group RRSP provides plan members with the benefit of pre-tax payroll contributions and investment earnings are tax-sheltered until withdrawal.

Benefits of Link’s GRRSP:

- Lower fees and suitable investments

- Contributions are eligible for Home Buyers’ Plan (HBP) and Lifelong Learning Plan (LLP)

- Build employees retirement savings by matching their contributions

Multi Employer Pension Plans

Support your plan members retirement income with Link’s Defined Contribution Multi- Employer Pension Plan (DC MEPP). MEPPs help plan members save for retirement since most contributions are locked-in and cannot be withdrawn early.

Benefits of Link’s MEPP:

- Lower fees through pooling and Link acting as plan sponsor and administrator

- Tax-deductible contributions

- Locked-in contributions help employees save for retirement

Defined Contribution Pension Plans

Help support your plan members during retirement with a Defined Contribution Pension Plan (DCPP). Both employer and employee contribute a defined amount annually into the DCPP helping ensure employees have an income during retirement.

Benefits of Link’s DCPP:

- Lower fees

- Tax-deductible contributions

- Contributions locked-in for retirement

Group Tax Free Savings Accounts

Setting up a Group Tax Free Savings Account (GTFSA) offers your plan members a flexible tax-free investment option to help them save for their short and long-term financial goals. Plan members can use it towards vacations, education, home renovations or other life events. GTFSAs are a great addition to any retirement savings plan.

Benefit of Link’s GTFSA:

- Lower fees

- No tax on their investment earnings or withdrawals

- Contributions can be made through regular payroll deductions

Ready to get started?

Connect with a LINK plan specialist to find the right solutions for your organization .